What is WebSacco?

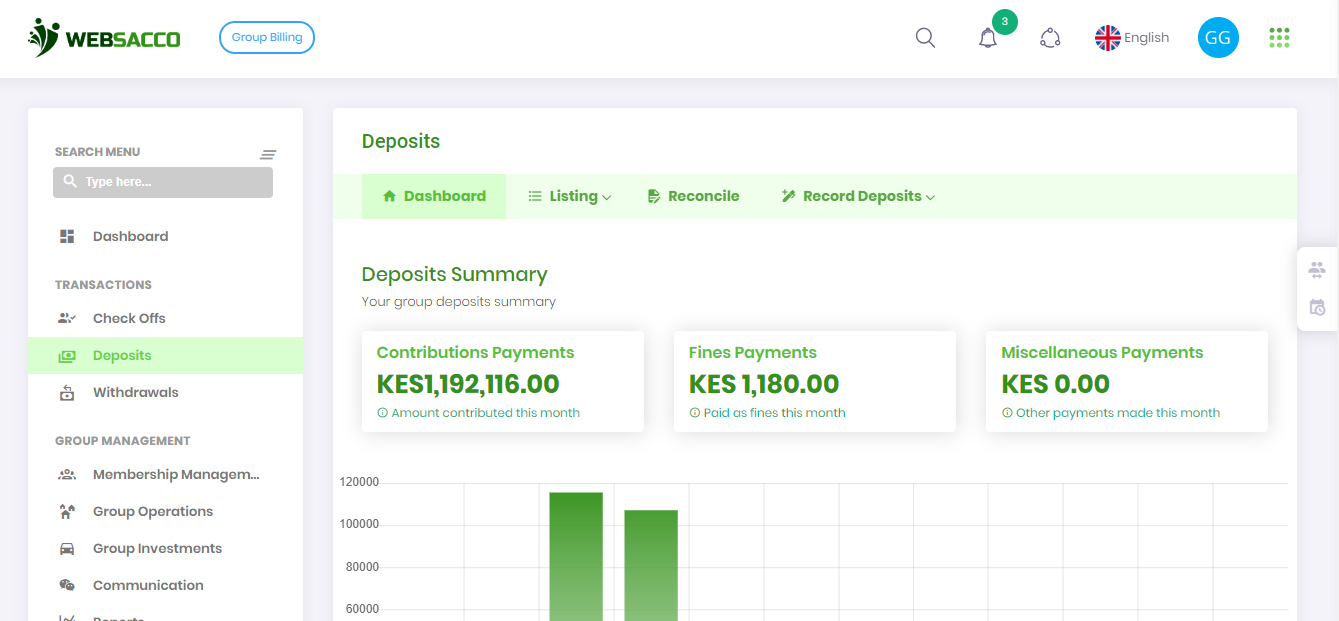

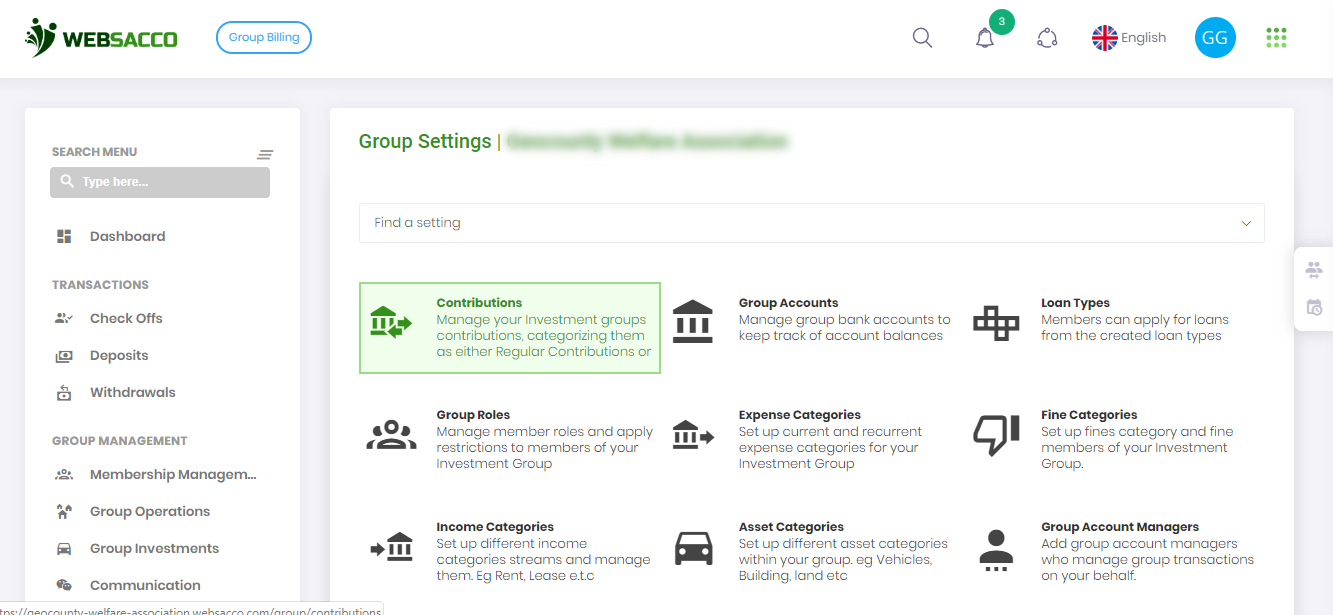

WebSacco is a platform that will provide your sacco, your digital lending business or your microfinance with all the tools you need to run a profitable and digitally aware enterprise. We provide a cloud version which you can test drive here and we also provide a solution you can install. We have member tools which will enable your Sacco member to save, borrow and repay through their mobile phones. We provide an omnichannel toolset which encompass: USSD platform, Android App and iOS App (Coming Soon).

Why use WebSacco?

When it comes to managing your SACCO finances, one needs a tool that eases the workload, is accurate, secure and accessible. Financial information stored on WebSacco is done securely ensuring your information is only visible to authorized users. We are available anywhere 24/7 as long as you have a reliable Internet connection.

WebSacco provides an enterprise-class security architecture which enables your SACCO account to be integrated with core banking, also designed and engineered for large scale SACCOs, which possesses high sophistication and great performance.

Still not convinced? Try out our demo.

Get a feel of WebSacco from the online demo now.